|

|

|

www.design-reuse-embedded.com

www.design-reuse-embedded.com |

|

Semiconductor Leaders' Marketshares Swell Over the Past 10 Years

Top 10 companies held 60% of worldwide semiconductor market in 2018, up from 45% in 2008.

January 15, 2019 -- IC Insights is in the process of completing its forecast and analysis of the IC industry and will present its new findings in The McClean Report 2019, which will be published later this month. Among the semiconductor industry data included in the new 400+ page report is an analysis of the top-50 semiconductor suppliers.

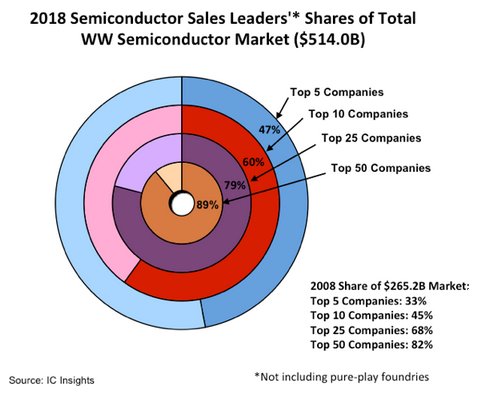

Research included in the new McClean Report shows that the world’s leading semiconductor suppliers significantly increased their marketshare over the past decade. The top 5 semiconductor suppliers accounted for 47% of the world’s semiconductor sales in 2018, an increase of 14 percentage points from 10 years earlier (Figure 1). In total, the 2018 top 50 suppliers represented 89% of the total $514.0 billion worldwide semiconductor market last year, up seven percentage points from the 82% share the top 50 companies held in 2008.

As shown, the top 5, top 10, and top 25 companies’ share of the 2018 worldwide semiconductor market increased 14, 15, and 11 percentage points, respectively, as compared to 10 years earlier in 2008. With additional mergers and acquisitions expected over the next few years, IC Insights believes that the consolidation could raise the shares of the top suppliers to even loftier levels.

There was a wide 66-percentage point range of year-over-year growth rates among the top 50 semiconductor suppliers last year, from +56% for Nanya to -10% for Fujitsu. Nanya rode a surge of demand for its DRAM devices to post its great full-year results. However, evidence of a cool down in the memory market last year was evident in the company’s quarterly sales results, which saw its sales drop from $826 million in 2Q18 to $550 million in 4Q18 (a 33% plunge). Overall, four of the top seven growth companies last year—Nanya, SK Hynix, Micron, and Samsung—were major memory suppliers. Although Nanya registered the highest percentage increase, Samsung had the largest dollar volume semiconductor sales increase, a whopping one-year jump of $17.0 billion!

In total, only nine of the top 50 companies registered better growth as compared to the 2018 worldwide semiconductor market increase of 16%, with five companies logging increases of ≥30%. In contrast, only three of the top 50 semiconductor companies logged a decline in sales last year, with Fujitsu being the only company to register a double-digit sales drop.

Figure 1

Report Details: The 2019 McClean Report

Rankings of the top 50 semiconductor suppliers, as well as the top 50 fabless IC suppliers, are included in the 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, which will be released in late January 2019. A subscription to The McClean Report includes free monthly updates from March through November (including a 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to the 2019 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

As part of your 2019 subscription, you are entitled to free attendance at a McClean Report half-day seminar (one seat for each copy purchased; company-wide licensees receive five free seats). The schedule for this year’s McClean Report seminar tour is shown below.

- Tuesday, January 22, 2019 — Scottsdale, Arizona

- Thursday, January 24, 2019 — Sunnyvale, California

- Tuesday, January 29, 2019 — Boston, Massachusetts

Back

Back Contact Us

Contact Us